Florida's Insurance Market Thrives: Homeowners See Glimmers of Hope!

Florida's property insurance market sees its best year since 2015 amid hurricanes, legislative reforms, and rising premiums. Explore the changes impacting homeowners today.

Florida's Insurance Market Thrives: Homeowners See Glimmers of Hope!

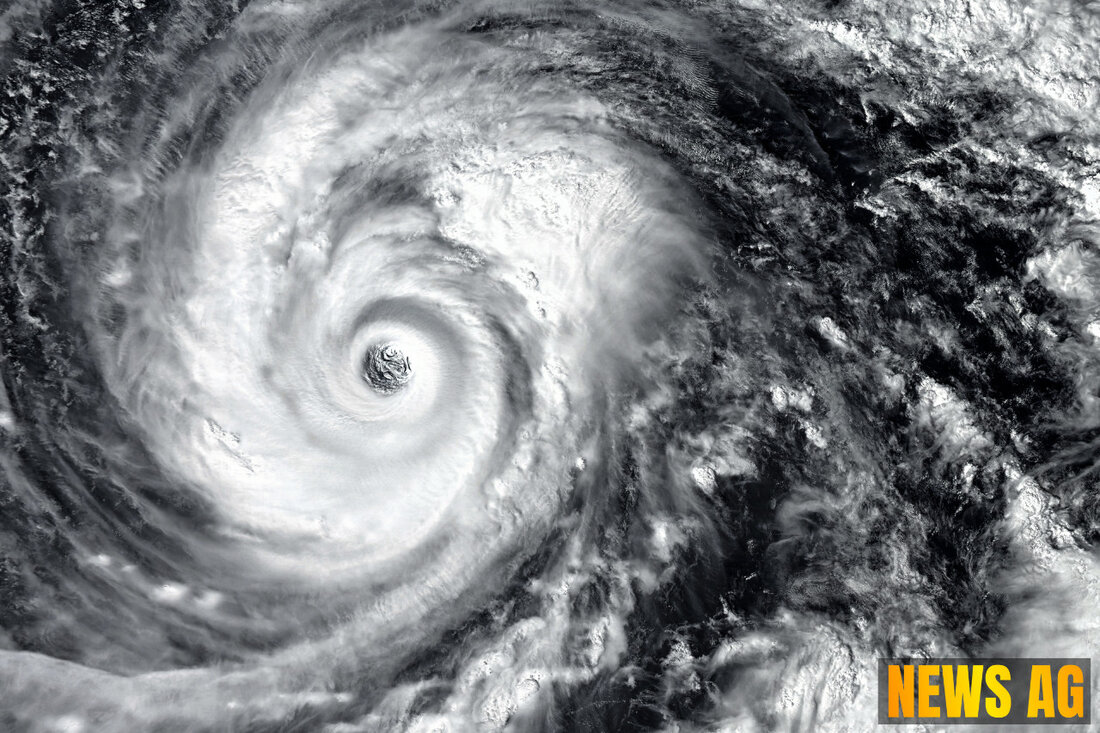

In a notable turn of events, Florida’s property insurance landscape is witnessing its best year since 2015, as reported by the Palm Beach Post. For the first time in nearly a decade, insurance companies in the state collected more in premiums than they paid out in claims, a significant shift attributed to legislative changes and market stabilization efforts. However, despite this bright spot, many homeowners still grapple with high insurance costs linked to the state’s vulnerability to hurricanes and the rising costs of reinsurance.

In 2024, Florida-based insurers managed to collect more premiums even while facing the wrath of three hurricanes. Mark Friedlander from the Insurance Information Institute noted that this underwriting profit signals improved financial health for the property insurance market. Legislative reforms implemented in 2022, particularly changes in tort law and restrictions on assignment of benefit agreements, have been instrumental in curbing the legal abuses that once plagued the industry.

Ongoing Challenges

However, the improvements are bittersweet as policyholder complaints continue on the rise, with many expressing frustration regarding their experiences with property insurers. While the state’s legislative changes seem to have made a positive impact, the cost of property insurance has surged by 42.5% since 2019, according to Florida Tax Watch. Factors such as excessive litigation and significant hurricane damage have created an environment where many insurance providers have either become insolvent or exited the state, limiting options for consumers.

Citizens Property Insurance Corp., the state-sponsored insurer of last resort, now caters to over one million Floridians, highlighting the failures of the private market to meet residents‘ insurance needs. This growing reliance on state coverage poses financial risks to taxpayers, as legislative efforts to stabilize the market are deemed necessary moving forward.

Future Prospects

Looking ahead, the Florida Property Insurance Stability Report suggests some hope with ongoing reforms that invite new insurers to enter the market. This influx of competitors may lead to more favorable pricing for homeowners who have been squeezed by rising costs. Nonetheless, insurance premiums are predicted to rise further in 2024, especially as the state prepares for another hurricane season amidst concerns about affordability.

Homeowners are encouraged to stay vigilant, evaluating their insurance options based on local rates and risks, especially as regional disparities emerge. For example, Brevard and Orange Counties currently face some of the steepest insurance costs in Central Florida due to their coastal proximity. To help alleviate these burdens, programs like My Safe Florida Home are stepping in, offering grants for home inspections and improvements designed to bolster resilience against severe weather threats.

The application window for the My Safe Florida Home program opens on July 1, 2024, providing eligible homeowners an opportunity to reduce their insurance premiums through structural upgrades. With specific criteria, including having a homestead exemption and an insured home value under $700,000, this initiative is crucial for many looking to mitigate costs.

In summary, Florida’s property insurance market is on the road to recovery, yet many hurdles remain. While legislative changes are bearing fruit, ensuring affordability and accessibility in insurance remains an uphill battle. Homeowners should take proactive steps, leverage available resources, and stay informed as the landscape continues to evolve.

Suche

Suche

Mein Konto

Mein Konto