Florida's New Law: Year-Round Tax-Free Emergency Supplies for All!

Fort Myers, Florida, USA - As Florida gears up for the always-dramatic hurricane season, the state is taking proactive measures to ensure that residents can prepare effectively for potential threats. Thanks to a recently enacted law, disaster preparedness supplies will now be tax-free all year round—a significant change that empowers Floridians to stock up without the usual tax burden. Governor Ron DeSantis signed this legislation as part of a broader $1.3 billion tax cut package that aims to ease financial strains on families as they prepare for emergencies.

This new law establishes a permanent sales tax exemption for various disaster preparedness items. No longer will residents have to wait for seasonal tax holidays or worry about budget delays impacting their emergency supplies. Ed Willis, manager of Gavin’s Ace Hardware in Cape Coral, has welcomed this change, noting that it allows customers to shop for essentials like portable generators, batteries, and tarps without the rush. „We’ve seen steady foot traffic and are prepared for the year-round demand,“ says Willis. With inventory ready, he encourages residents to take advantage of the exemption and stock up at their convenience.

What’s Included in This Tax-Free Initiative?

The law covers a range of emergency supplies that are essential during hurricane season. Items that will be free of sales tax include:

- Batteries (various types)

- Portable generators (10,000 running watts or less)

- Waterproof tarps (1,000 square feet or less)

- Gas or diesel fuel cans (five gallons or less)

- Ground anchors

- Tie-down kits

- Smoke detectors

- Carbon monoxide detectors

- Fire extinguishers

- Life jackets

- Sunscreen

- Insect repellent

Residents should note that certain exemptions will also apply to traditional tax holidays, which are still scheduled during specific periods. The 2024 Disaster Preparedness Sales Tax Holiday is set to run from June 1-14 and August 24 – September 6. However, the permanent exemption now offers a continuous opportunity for shoppers to equip themselves without delay.

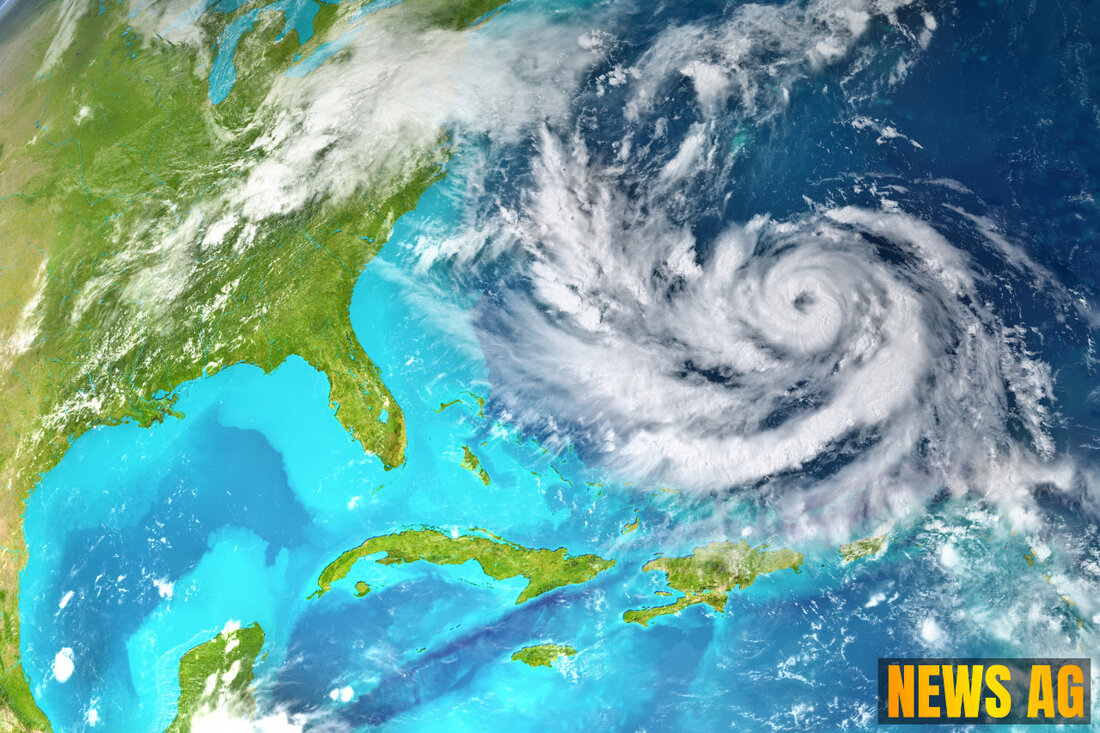

A Busy Hurricane Season Ahead

Dr. Michael Brennan, Director of the National Hurricane Center, points out that the 2025 hurricane season is predicted to be active, urging all Floridians to stay prepared. Although we are only in the early days, two named storms have already formed this season. As the Fourth of July approaches, a disturbance is expected to bring wet weather to parts of Florida, adding to the urgency for residents to gather their supplies.

With the Atlantic hurricane season running from June 1 to November 30, the new tax exemption is a timely boost for those looking to brace themselves for what could be a stormy few months ahead. Adding to the tax-free list are items like bottled water, first aid kits, and many grocery staples, already exempt from sales tax, which makes preparing for any disaster more accessible than ever.

The Department of Revenue has also taken steps to provide further information on the tax exemptions, ensuring that consumers know exactly what is available to them under this law. For more details and promotional materials, residents can visit the Department of Revenue webpage.

In short, the year-round sales tax exemption for disaster preparedness supplies is a win-win for Florida’s residents. As the saying goes, „It’s better to be safe than sorry,“ and this initiative makes it easier for the community to stay prepared with the right tools at their fingertips.

| Details | |

|---|---|

| Ort | Fort Myers, Florida, USA |

| Quellen | |