Florida's Citizens Insurance Secures $4.49B Amid Rising Hurricane Risks

Florida's Citizens Insurance secures $4.49 billion for hurricane season 2025, amidst rising demand and changing market dynamics.

Florida's Citizens Insurance Secures $4.49B Amid Rising Hurricane Risks

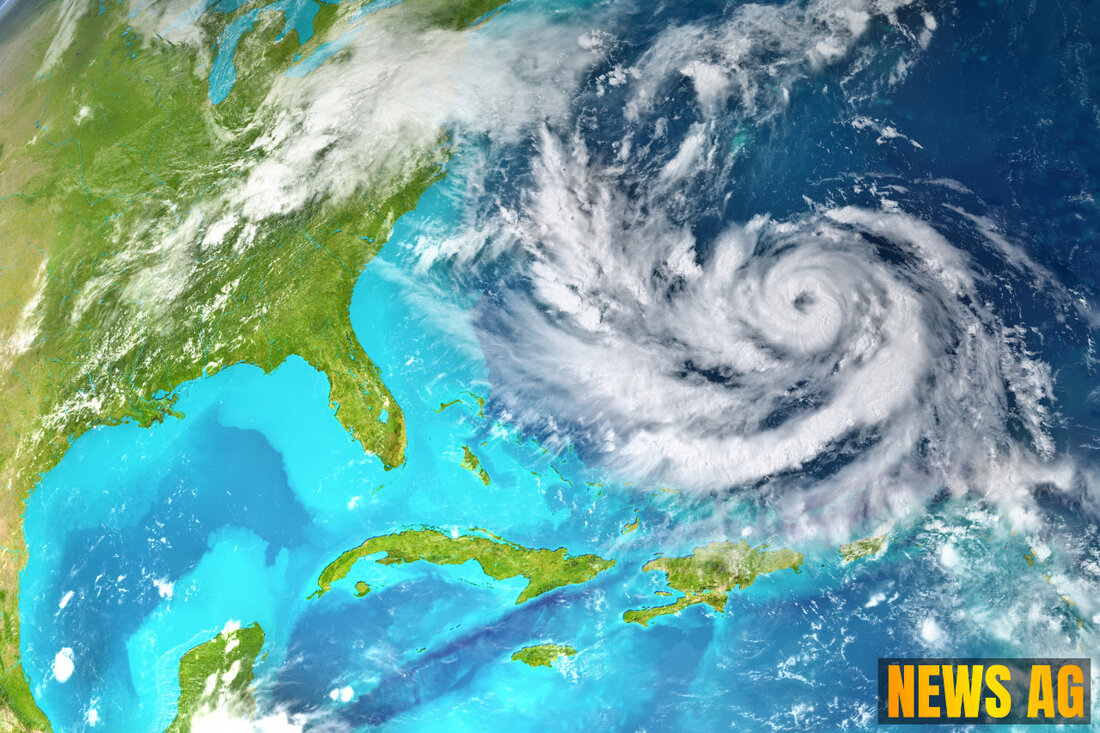

As the 2025 hurricane season approaches, Florida’s homeowners are bracing for challenges in the insurance landscape, with major implications on both personal finances and the broader market. Florida’s Citizens Property Insurance Corporation recently completed its reinsurance renewal, securing a staggering $4.49 billion in total risk transfer to safeguard against the anticipated storms. This amounts to an impressive 87% backing from catastrophe bonds and insurance-linked securities (ILS) fund managers, according to Artemis.

The breakdown of this coverage reveals a concerted effort to fortify Florida’s insurance market. For 2025, the target includes nearly $2.89 billion in new catastrophe bonds alongside $1.6 billion from existing deals. Notably, a sizeable portion, approximately $1.369 billion, has been secured through traditional reinsurance methods. While this indicates a shifting landscape, the reliance on capital markets has surged – rising from 81% last year to 87% this year in overall capacity.

Rising Demand and Market Pressures

Florida’s home insurance market, valued at an astounding $76 billion, is on a trajectory of growth following a challenging contraction period. The state’s increasing population, swelling by around 300,000 people every year, has only intensified the demand for insurance products. However, this demand comes amid heightened vulnerabilities in the face of climate change, which is expected to exacerbate storm intensity in coming years. Economic losses from hurricanes Irma and Ian alone exceeded $60 billion and have driven many private insurers out of the market, a trend that has contributed to homeowner rates skyrocketing to more than three times the national average, as reported by Fortune.

Despite these challenges, Citizens Property Insurance Corp. has seen significant growth, currently underwriting 1.4 million policies, making it the tenth-largest property insurer nationwide. Yet, the specter of insolvency looms large, with investigations hinting the company might require taxpayer or federal assistance should a major hurricane occur. Seeking peace of mind, Citizens is pursuing up to $5.5 billion in reinsurance coverage, its largest acquisition to date.

The Catastrophe Bond Market: A Double-Edged Sword

The catastrophe bond market, which initially gained traction in the wake of Hurricane Andrew in the 1990s, presents a mixed bag for investors and insurers alike. As pressures mount from recent hurricanes, including Helene and Milton, investor risk tolerance could be put to the test. Marketplace notes that while higher returns attract interest in these bonds—around 11%—the recent loss activity might necessitate higher premiums to draw investors. Current estimations suggest insurance market losses could soar between $15 billion and $40 billion due to escalating natural disasters.

As investors pour a significant amount into these instruments—over $13 billion in new cat bonds have been tracked this year—the total market nears $48 billion. However, with rising costs in homeowners insurance linked to these developments and the continuous threat of increasing extreme weather events, the industry must maintain a fine balance between risk and reward.

In conclusion, Florida’s insurance scene is undergoing a major transformation, with catastrophic bonds playing a pivotal role in both risk transfer and financial strategy. As we navigate this hurricane season, the interplay of market forces and public policy will be essential in shaping the future for homeowners across the Sunshine State.

Suche

Suche

Mein Konto

Mein Konto